Introduction

Presentation of Zyra Expert Advisor: Combining Performance and Robustness

Our Zyra Expert Advisor (EA) is a proven swing trading solution designed to assist traders in making smarter trading decisions. What sets us apart in the market is our unique approach that incorporates multiple strategies simultaneously.

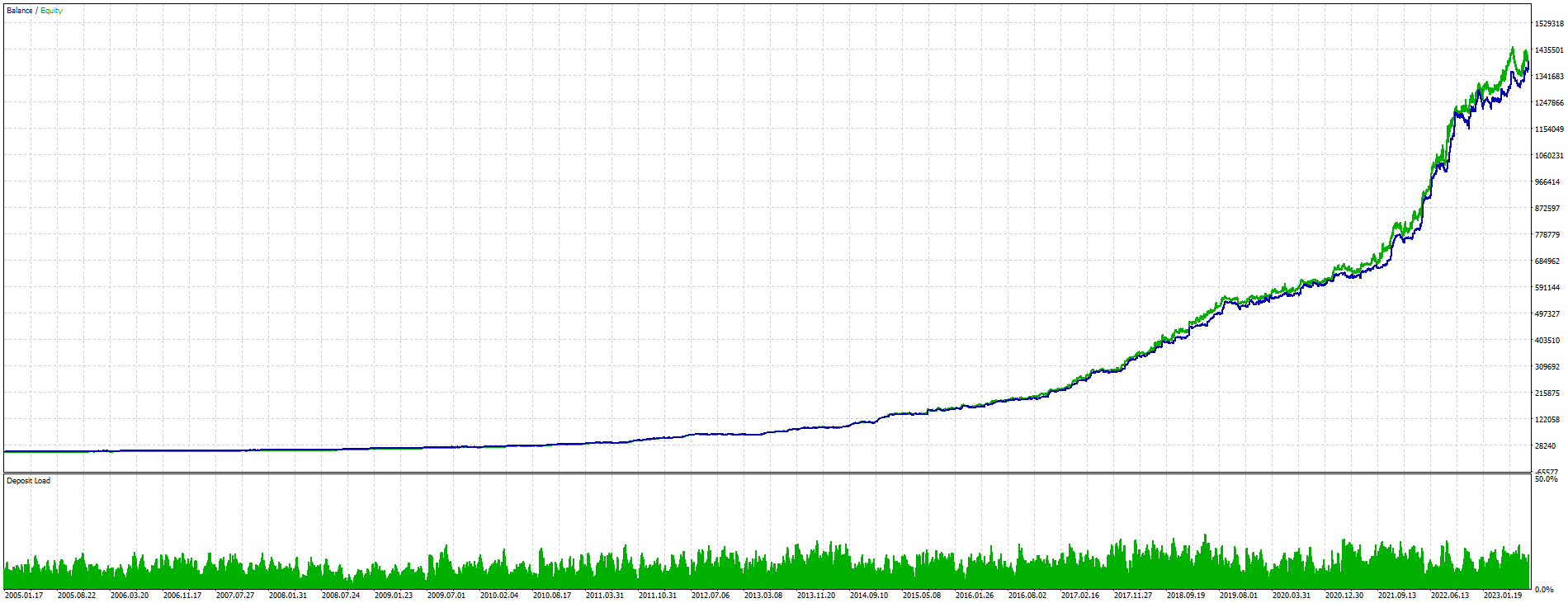

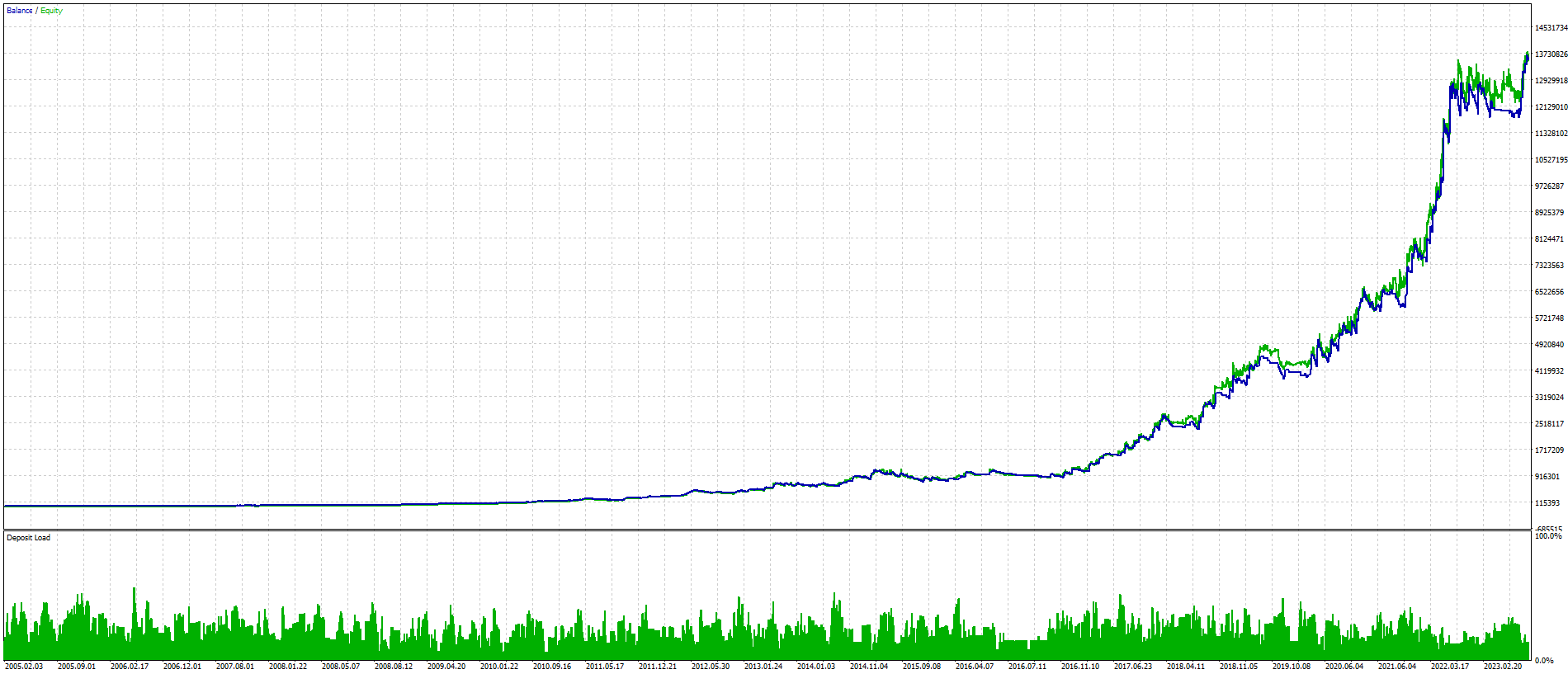

With sophisticated algorithms, Zyra constantly analyzes the market to identify trends and potential entry and exit points. We have individually tested and optimized each strategy using over 18 years of historical data to reduce the risk of curve fitting.

The robustness of our strategies is a crucial aspect for our clients. Unlike some risky EAs, Zyra does not employ strategies such as Grid or Martingale, which can lead to catastrophic losses. Each trade is equipped with a Stop Loss and Take Profit to ensure a Risk-Reward ratio of at least 2, minimizing the risk of loss.

We are proud to highlight that Zyra is designed to operate independently of brokers or VPS, and does not require a fast internet connection or expensive VPS. This allows our users to save on brokerage and VPS fees, while focusing on optimizing their trading strategy without worrying about system performance.

Zyra is designed to work on an H1 timeframe but also considers daily, weekly, and monthly periodicity data. With proper customization, you can choose which strategies to use for each currency pair you follow. Additionally, Zyra does not require regular updates to adapt to market conditions, allowing you to spend more time making the right trading decisions.

The robustness of our strategies has been verified through a series of rigorous tests. We conducted high precision tests using Dukascopy ticks, ensuring high accuracy in the quality of backtesting. Additionally, we performed Monte Carlo simulations to assess the resilience of our strategies to market variations and uncertainties. We also employed the Overcome Curve Fitting (OCF) method to evaluate the sensitivity of our strategies to excessive optimization.

These comprehensive tests aim to eliminate strategies that are too dependent on historical data and strengthen the probability of an effective long-term strategy. However, it is important to note that past performance does not guarantee future results, and trading always carries risks.

At Zyra, we are committed to providing a comprehensive and reliable solution to enhance our clients' trading performance. In addition to our Expert Advisor, we offer installation assistance and quality technical support. Our goal is to help our clients achieve a composite annual return rate of 10% with an annual risk limit of 5%, while ensuring simplicity and consistency in their trades.

Join us today and experience the benefits of Zyra Expert Advisor to enhance your trading journey. Keep in mind that trading involves risks, and it is important to exercise caution and manage risk appropriately. Our team is here to support you and help maximize your trading potential.